Tax Invoice Format India (GST) – Sample Invoice & PDF Download

A tax invoice is a crucial document for any GST-registered business in India. It serves as a formal bill for goods or services supplied and is essential for tax compliance. This format guide is designed for small business owners, accountants, and retailers who need a clear, professional, and GST-compliant tax invoice. Unlike a simple bill of supply, a tax invoice details the GST charged, which is mandatory for the buyer to claim Input Tax Credit (ITC).

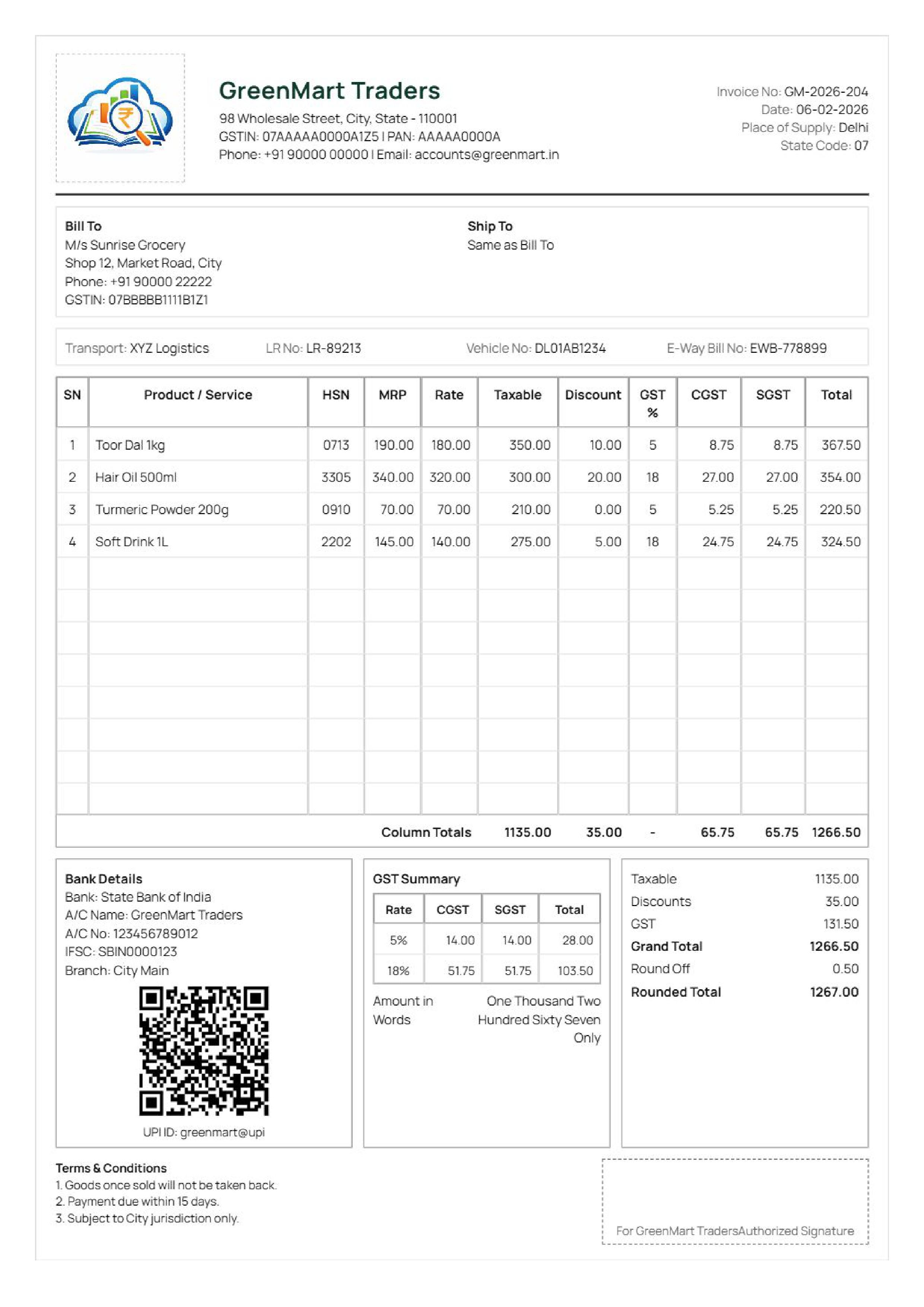

Tax Invoice Format India – A4 (GST)

This standard A4 tax invoice format is ideal for all professional business transactions. It includes all mandatory GST fields:

- Supplier & Buyer Name, Address, & GSTIN

- Unique Invoice Number & Date

- Description of Goods/Services with HSN/SAC Codes

- Taxable Value & Tax Rate

- CGST, SGST, or IGST Breakdown

- Total Invoice Value

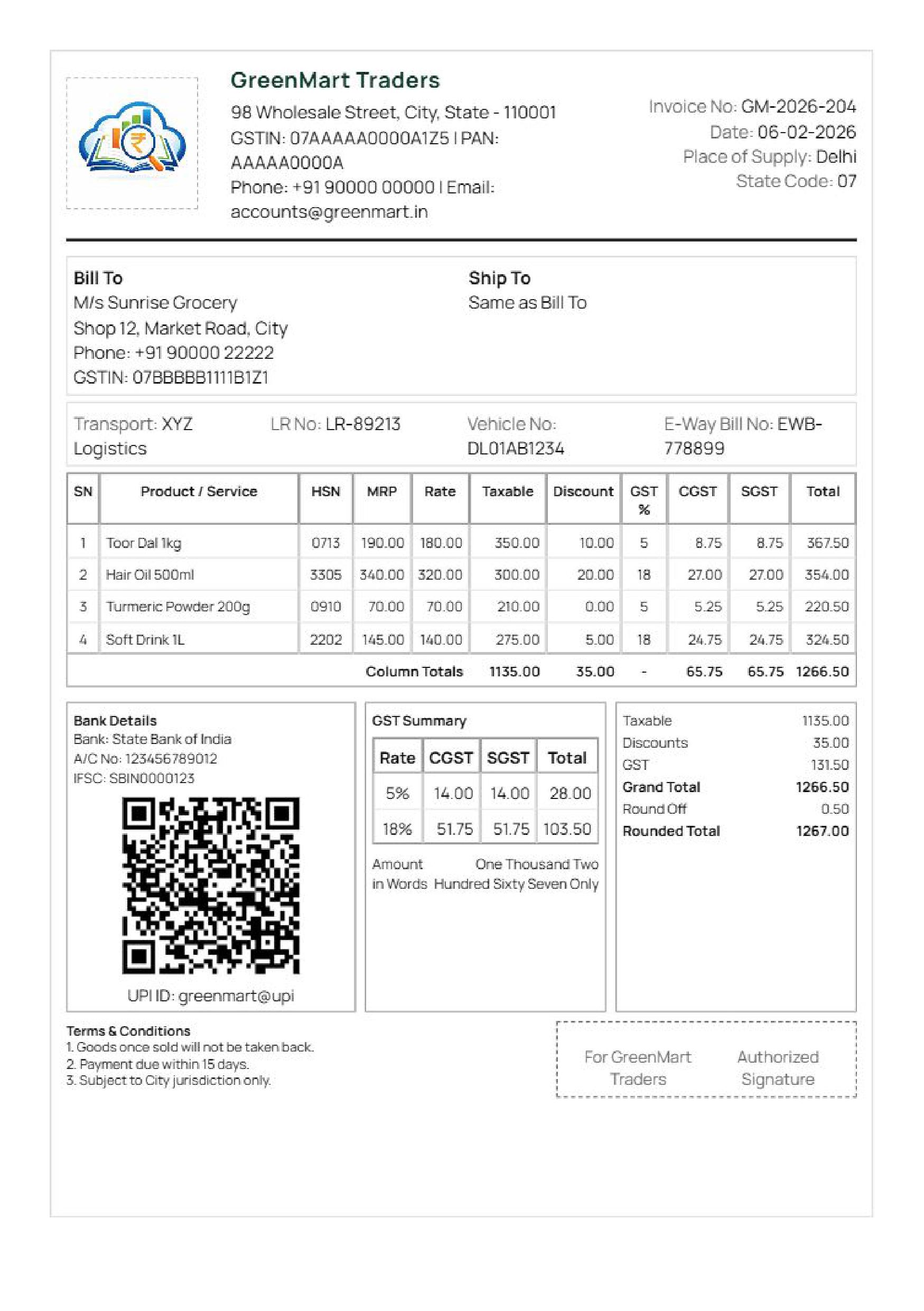

Tax Invoice Format India – A5 (Compact)

A compact A5 format, perfect for smaller printouts and faster billing:

- Space-efficient layout for retail and service counters

- Suitable for thermal printers and small shops

- Contains all essential GST compliance details

GST Rules for Tax Invoice in India

Under GST law, a tax invoice must be issued on or before the date of removal of goods or within 30 days from the date of supply of services. It is the primary document for a buyer to claim Input Tax Credit (ITC).

For intra-state sales, you must charge CGST and SGST. For inter-state sales, only IGST is applicable. Maintaining a unique and sequential invoice number series for each financial year is a strict legal requirement, crucial for GST returns and audits.

Generate GST Tax Invoices Automatically with Billing Software

Manual invoicing using Word or Excel templates is slow, prone to GST calculation errors, and creates compliance risks. Managing invoice numbers and filing returns becomes a time-consuming headache.