Restaurant Bill Format (GST) – Sample Invoice & PDF Download

A restaurant bill is a crucial document detailing a customer's order and total payment due. In India, it's mandatory for GST-registered restaurants to issue a tax invoice in a specific format. This format is essential for restaurant owners, managers, and accounting staff to maintain compliance, manage finances accurately, and provide customers with a clear, professional bill. Our guide provides downloadable PDF samples for your business.

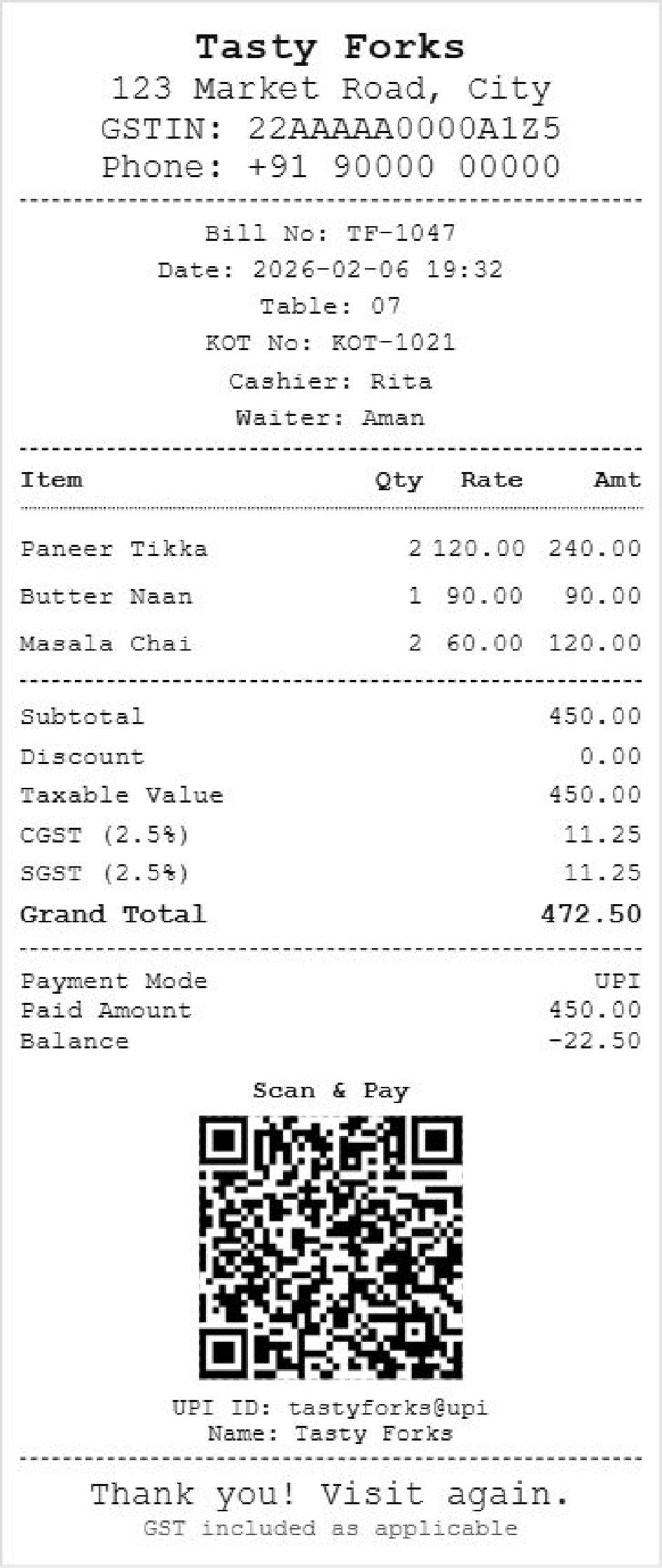

Restaurant Bill Format – GST Sample (Version 1)

This simple GST restaurant invoice format includes all the essential fields:

- Restaurant Name, Address & GSTIN

- Unique Invoice Number & Date

- Itemized list with Name, Quantity, and Rate

- Separate CGST & SGST columns for tax breakdown

- Clear Grand Total Amount

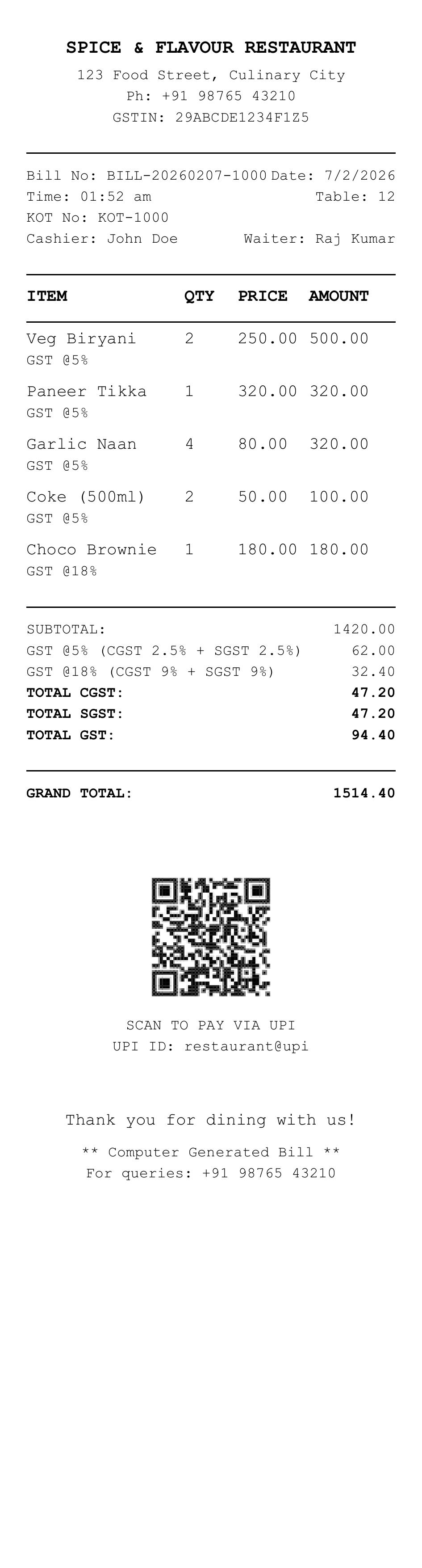

Restaurant Bill Format – GST Detailed (Version 2)

This detailed format adds more clarity for professional use cases:

- Includes all fields from the simple version

- Dedicated section for applying Discounts

- Optional field for Service Charge

- HSN/SAC codes for each item

- Clearly mentioned Payment Mode (Cash, Card, UPI)

- Round-off calculation for a clean total

Mandatory GST Details in Restaurant Invoice (India)

Under Indian GST law, a registered restaurant must issue a "tax invoice" for every transaction. This is different from a simple "bill" or "challan" as it contains legally required tax information. It's crucial to charge CGST (Central GST) and SGST (State GST) for dine-in and takeaways. IGST (Integrated GST) applies only if you provide catering services to a customer in another state.

Maintaining a sequential and unique invoice number series for each financial year is a strict compliance requirement. This helps in tracking all transactions and is essential for accurate GST return filing.

Generate Restaurant Bills Automatically with Billing Software

Using manual PDF or Excel formats is slow and prone to errors. A small mistake in GST calculation can lead to compliance issues. Our Restaurant Billing Software eliminates these risks by automating everything.