Pharmacy Invoice Format (GST) – Retail & Wholesale Samples

A pharmacy invoice is a legal document detailing medicines sold, quantities, and prices. In India, it is mandatory for GST-registered pharmacies to issue a tax invoice that includes specific fields like batch number, expiry date, and GSTIN. This is essential for retail pharmacy owners, wholesale distributors, and accounting staff to ensure compliance, manage inventory accurately, and provide customers with clear, professional bills. These formats are designed to meet these needs.

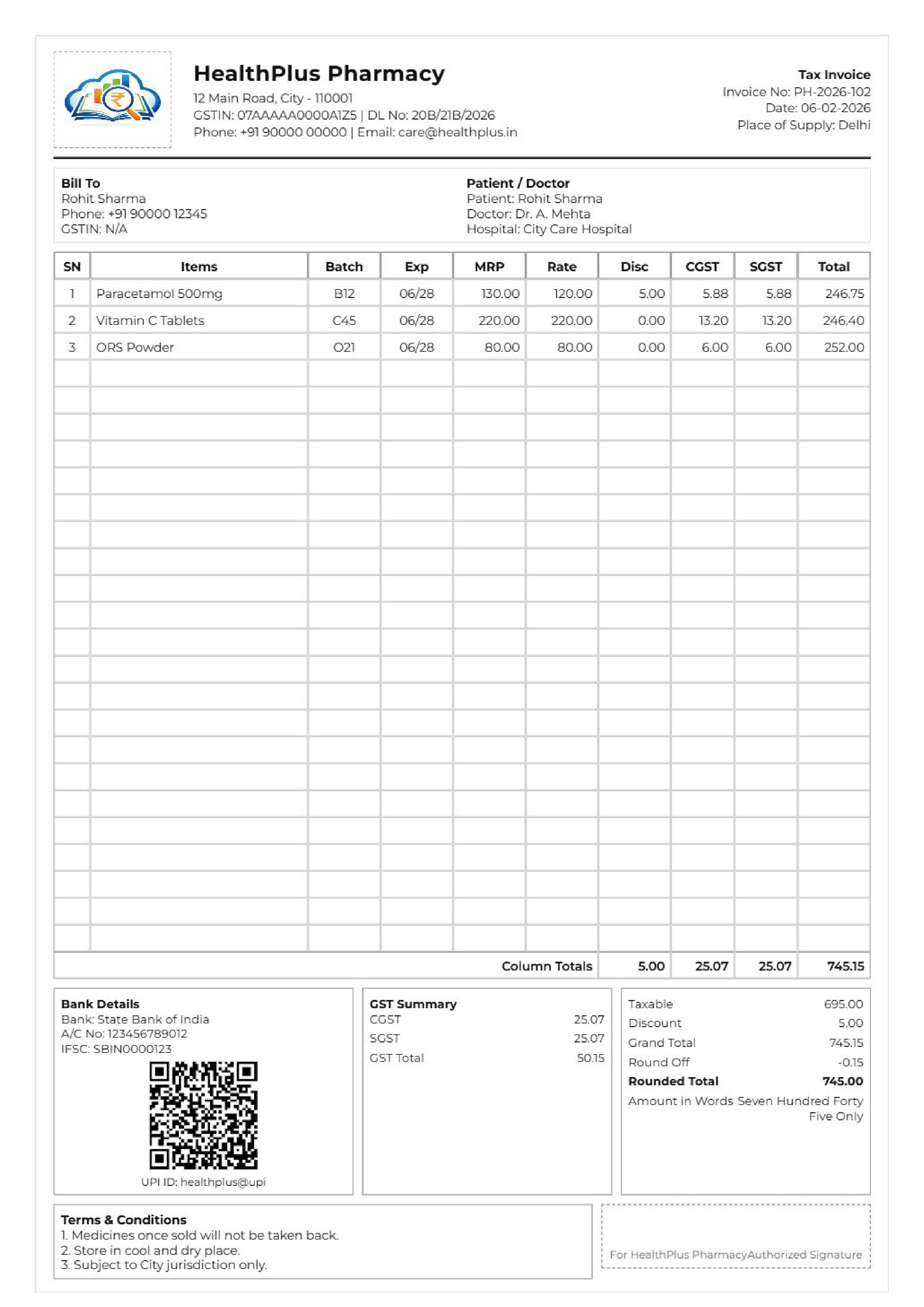

Retail Pharmacy Invoice Format – A4 (GST)

This standard A4 format is ideal for detailed retail pharmacy billing. It includes all mandatory GST fields:

- Pharmacy Name, Address & GSTIN

- Drug Name, Batch Number & Expiry Date

- Quantity & MRP

- Separate CGST & SGST tax breakdown

- Total payable amount

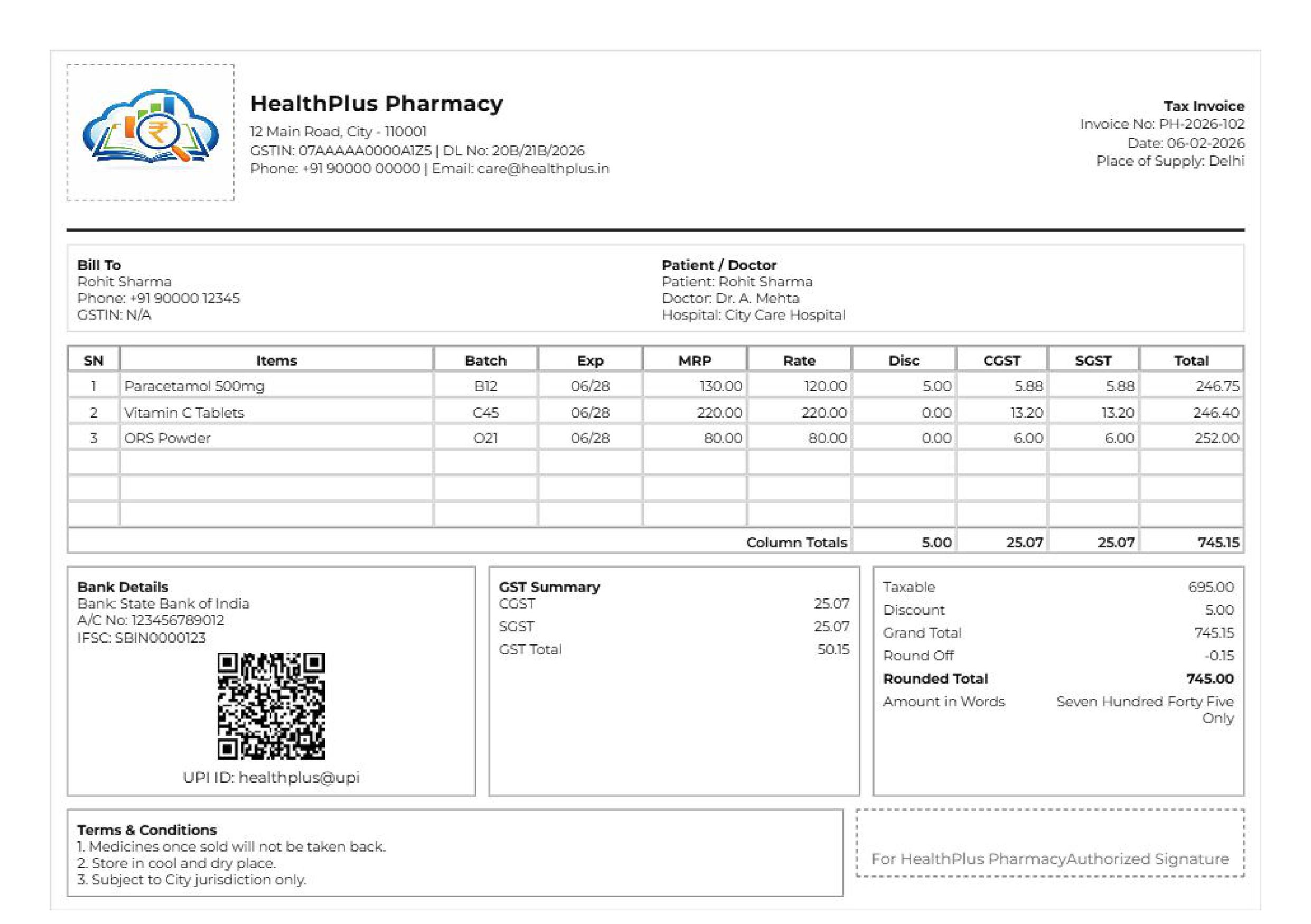

Retail Pharmacy Invoice Format – A5 (Compact)

A compact A5 format perfect for smaller printouts or thermal printers:

- Space-efficient layout for quick billing

- Best for walk-in customer sales in busy medical stores

- Contains all essential GST and drug compliance details

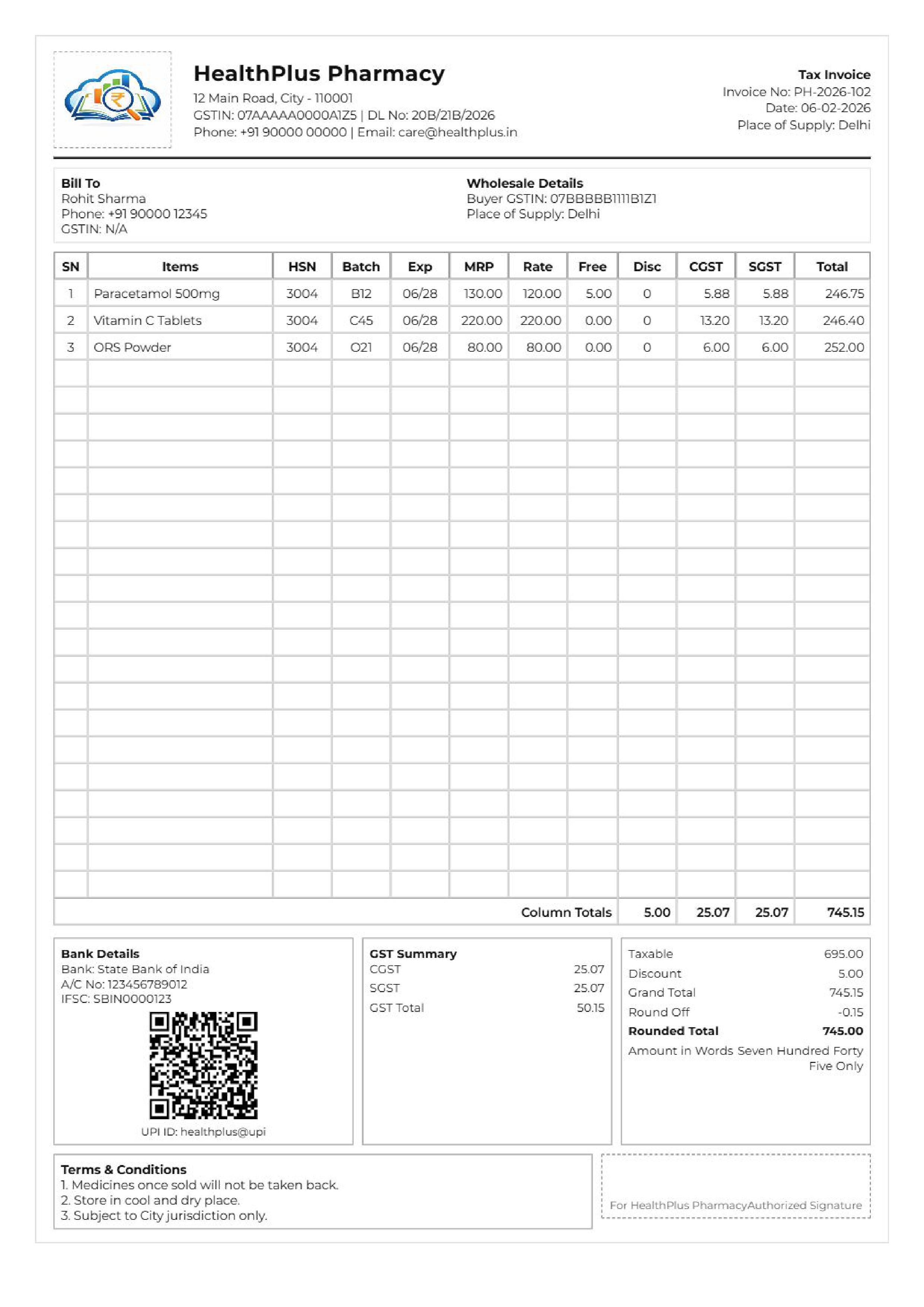

Wholesale Pharmacy Invoice Format – A4 (GST)

Designed for B2B transactions between distributors and retailers. Includes additional fields for wholesale compliance:

- Buyer's Name, Address, and GSTIN for input tax credit

- HSN codes for each drug

- Taxable value for clear GST calculation

- Bulk quantity pricing

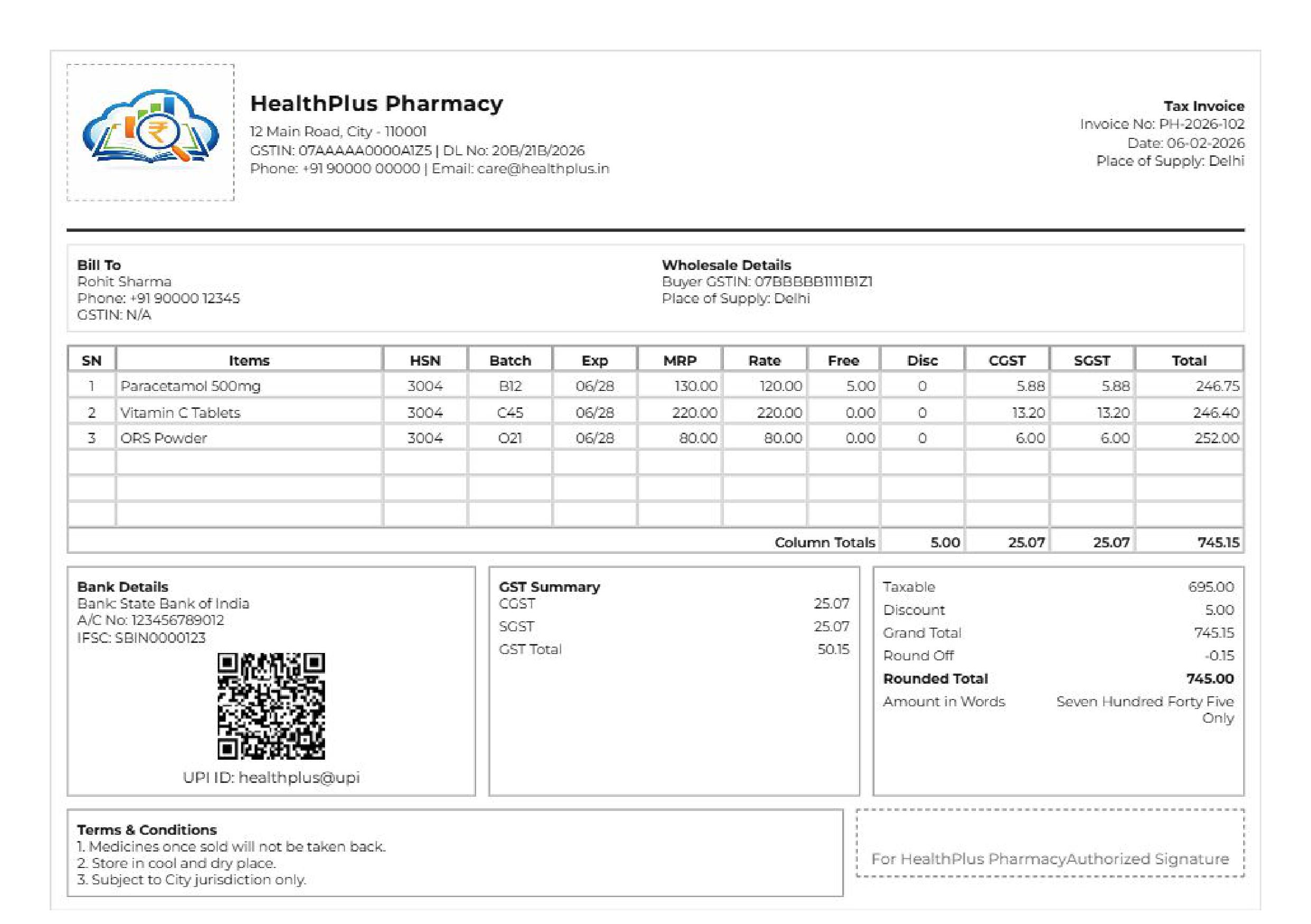

Wholesale Pharmacy Invoice Format – A5

A compact format for wholesale billing, often used for smaller orders or as a delivery challan:

- Efficient layout for quick wholesale transactions

- Can be used as a delivery challan-style invoice

- Maintains all necessary wholesale and GST details

Mandatory GST Details in Pharmacy Invoices (India)

Under Indian GST law, every registered pharmacy must issue a "tax invoice." For B2B (wholesale) transactions, this must include the buyer's GSTIN. For B2C (retail) sales, it's optional unless the customer requests it.

A crucial compliance requirement for pharmacies is the inclusion of the **Batch Number** and **Expiry Date** for every drug sold. This is mandated by both the Drugs and Cosmetics Act and GST rules. Maintaining a sequential invoice number series for each financial year is also a strict requirement for GST compliance and audits.

Automate Pharmacy Billing with GST-Compliant Software

Manual invoicing is slow and increases the risk of errors in GST calculation, batch tracking, and expiry management. This can lead to compliance issues and financial loss. Our Pharmacy Billing Software automates these critical tasks.