POS Bill Format (GST) – Sample Invoice & PDF Download

A Point of Sale (POS) bill is a compact receipt generated at checkout counters in retail stores, restaurants, and supermarkets. In India, it is crucial for this bill to be GST-compliant to serve as a valid tax invoice. This standardized format ensures quick billing, accurate tax collection, and simplified record-keeping for GST returns. This guide is for business owners and billing staff who need a clear, compliant POS bill format.

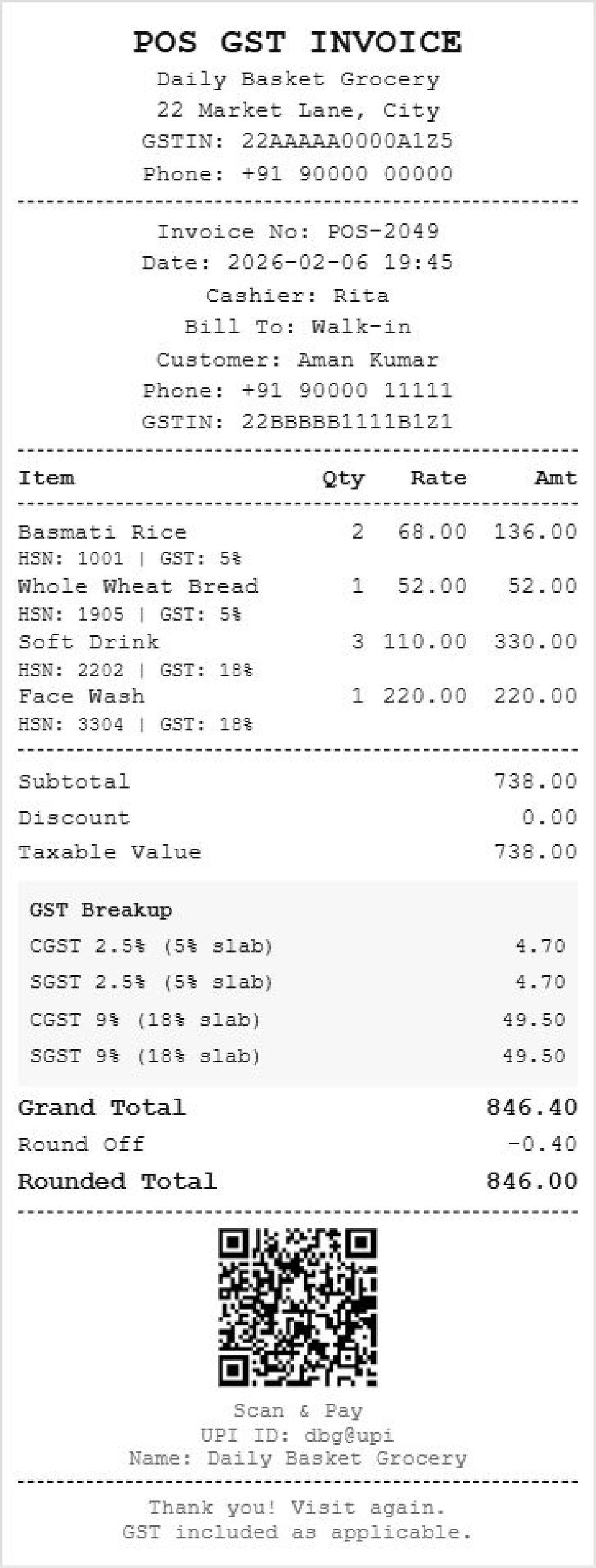

POS Bill Format – GST Invoice Sample

This standard POS GST bill format is suitable for fast billing at retail shops, restaurants, and supermarkets. Key fields include:

- Business Name, Address & GSTIN

- POS Terminal/Bill Number, Date & Time

- Itemized list with Quantity & Rate

- Taxable Value with CGST & SGST breakdown

- Total Bill Amount

Free sample POS bill format PDF. Signup may be required to download.

Mandatory GST Details in POS Bills (India)

For a business registered under GST, a POS bill issued to a customer (B2C) is considered a tax invoice. It must contain your GSTIN, a unique serial number, and a clear breakdown of CGST and SGST. IGST is applied only if you are providing goods/services to a customer located in another state, which is less common in a POS context.

Maintaining accurate POS bill records is legally required and essential for filing your monthly/quarterly GST returns (GSTR-1 and GSTR-3B). These bills serve as primary evidence of sales transactions during GST audits, so ensuring their compliance is critical.

Simplify Billing with POS Billing Software

Manual billing or outdated systems lead to slower checkouts, tax calculation errors, and poor sales tracking. This creates a bad customer experience and puts your business at risk of GST compliance issues.