Well, I’m here guiding you on about GST registration. I know that you have a business and want to know that how can you register for GST to get GSTIN number. GST registration is mandatory for some businesses and also depend upon the business turn over. Most important is that are you eligible for GST registration or not? You also want to know about the registration process and the required documentation. So, you can get the GSTIN and make business easy.

Learn More

Who can apply for GST Registration?

- Mostly, if you have business turn over or total sales more than 40 Lakh (However in some state like J&K, HP, UK & Northern-Eastern States, there is 10 Lakh threshold limit.) then you must go for GST registration.

- Do you sell product through e-commerce? if yes then you must go for GST Registration.

- Do you have pre-existing tax system like VAT, Excise, service tax, etc? Then you must migrate to GST registration.

- GSTIN should have if you are paying tax via the reverse charge.

- Selling online services like database access, data services, etc. should have GSTIN.

3 Easy steps for GST registration

1. Arrange Required Information and Documents

Before applying for GSTIN, you must have the following information and documents with you.

- PAN Card (with scan copy on your disk.)

- Aadhaar card of the promoter(scan copy).

- Photograph of the promoter (scan copy).

- Business Proof (with scan copy). Here you can give business registration proof.

- Business Address proof (with scan copy). You can use rent agreement as business address proof or utility bill etc.

- Bank Account details and bank statement/canceled cheque (scan copy).

- A digital signature or Adhaar card with registered mobile number to get Aadhaar OTP.

- Letter of Authorization/Board Resolution for Authorized Signatory (scan copy).

- A valid E-mail ID.

- Regular Mobile number.

2. GST Registration Process on GST portal

Upon completion of the first step of information and documentation, Now follow the below steps.

- First of all, go to GST portal.

- Find the Services tab in the main navigation bar.

- Upon click in services, Move the cursor to registration

- Then click on new registration.

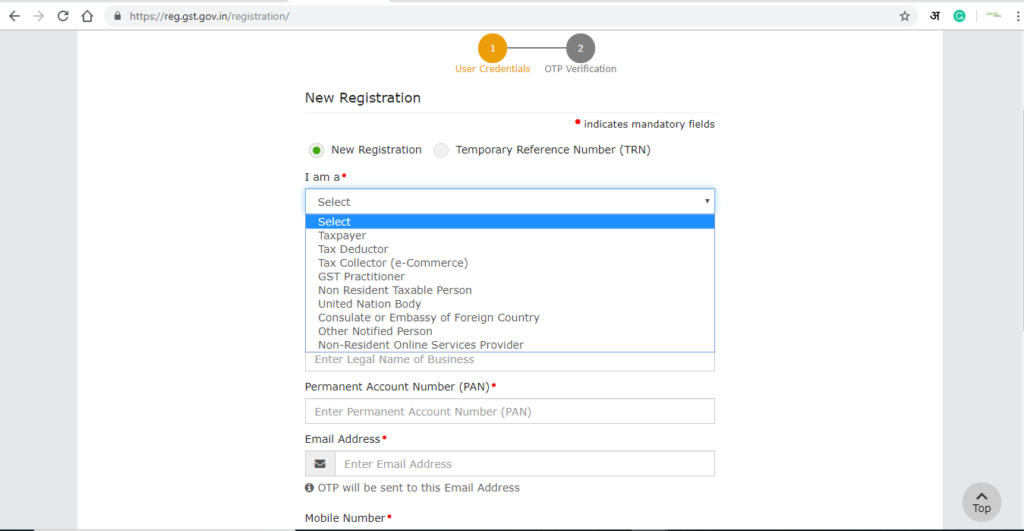

- Now you are on the registration form where you have two steps. One is User credential and the second one is OTP Verification.

- First, you to complete User Credential.

- In the first point, you have to select your what type of user you are. there are options like a taxpayer, Tax deductor, Tax collector, GST practitioner, non-resident taxable person, united nation body, consulate, other notified person, non-resident online services.

- Select your state/UT from drop-down

- Select your district from the drop-down.

- Enter Legal Name of the Business (As mentioned in PAN)

- Enter your Permanent Account Number (PAN)

- Email Address (OTP will be sent to this Email Address )

- Mobile Number ( Separate OTP will be sent to this mobile number)

- Type the characters you see in the image.

- Click on proceed.

- you will receive OTP on mobile number as well on the email address.

- Varify mobile and email with providing OTP.

3. GST Registration Steps (Non-Core fields)

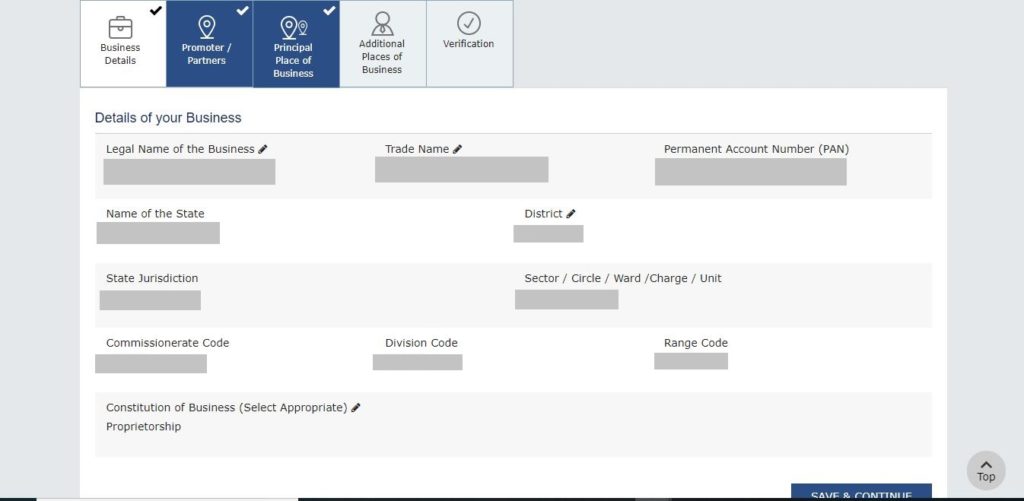

1. Business Details

In the business details section enter your business details as required below:

- Legal Name of the Business

- Trade Name

- Permanent Account Number (PAN)

- Name of the State

- District

- State Jurisdiction

- Sector / Circle / Ward /Charge / Unit

- Commissionerate Code

- Division Code

- Range Code

- Constitution of Business (Select Appropriate)

- Click on Save and Continue

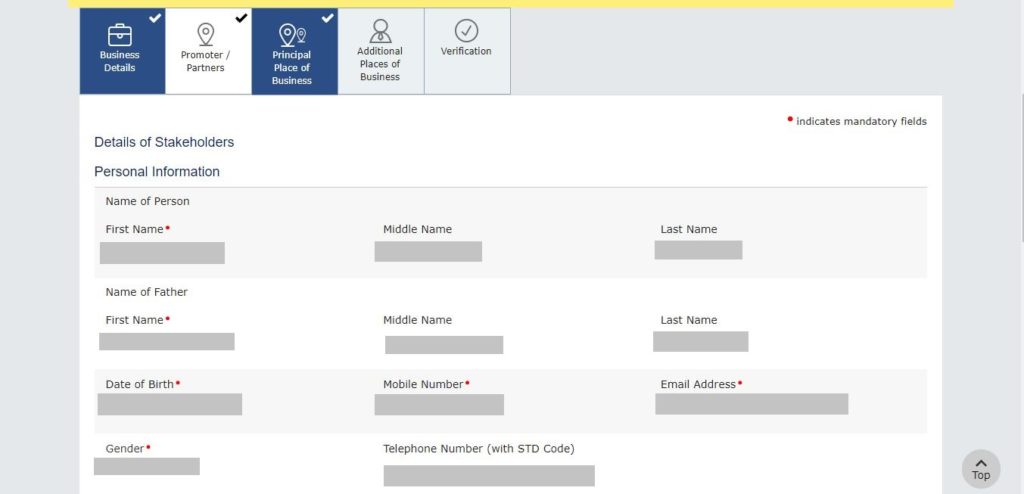

2. Promoter / Partners Details:

Now you need to fillup promoter/partner details as required.

- First Name, Middle name, and last name

- Name of Father

- Date of Birth

- Mobile Number

- Email Address

- Gender

- Designation / Status

- Director Identification Number

- Are you a citizen of India?

- Permanent Account Number (PAN)

- Passport Number (In case of Foreigner)

- Aadhaar Number

- Declaration

- Residential Address

- Upload promoter photograph

- Also Authorized Signatory

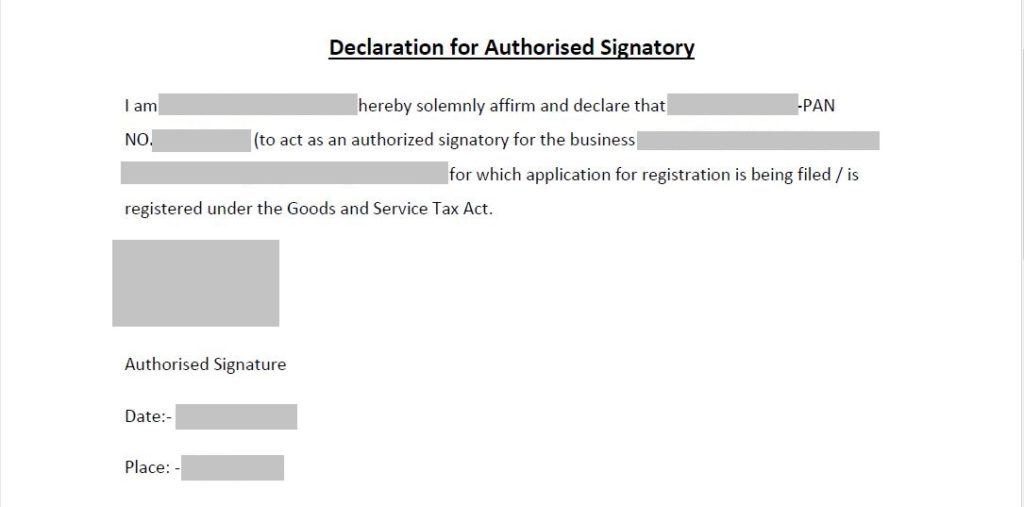

3. Authorized Signatory

In authorization signatory, you are one of an authorized signatory. You have the option to add authorization signatory who has a valid PAN number. Upload photo and authorization letter as mentioned below the image.

4. Authorized Representative

Appoint a representative for your GST portal access.

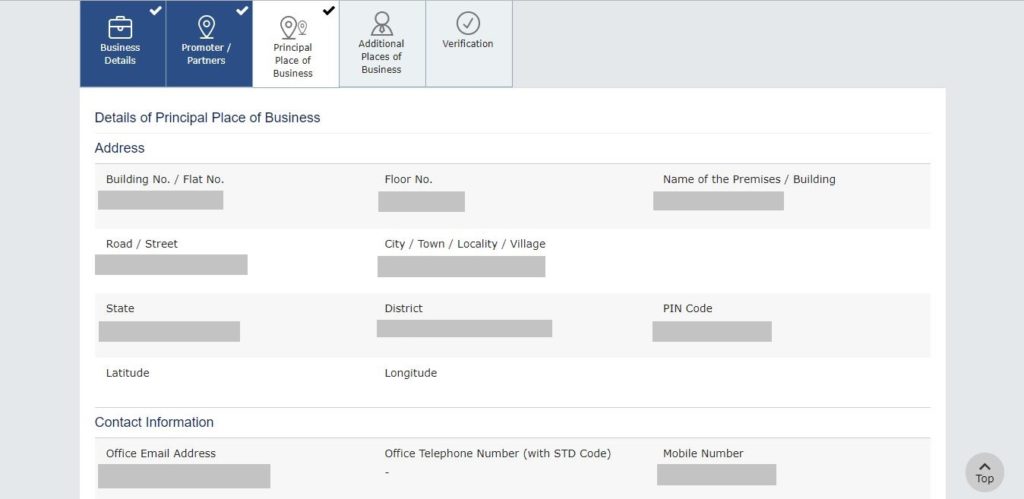

5. Principal Place of Business

Where is your business place? In this section, you need to submit your business place address with a proof of address.

- Address of place of business

- Contact Information with phone number and email id

- Nature of possession of premises: rented/own

- Document Upload: Upload Rent agreement or electricity bill copy or municipal tax receipt

- Nature of Business Activity being carried out at above-mentioned premises

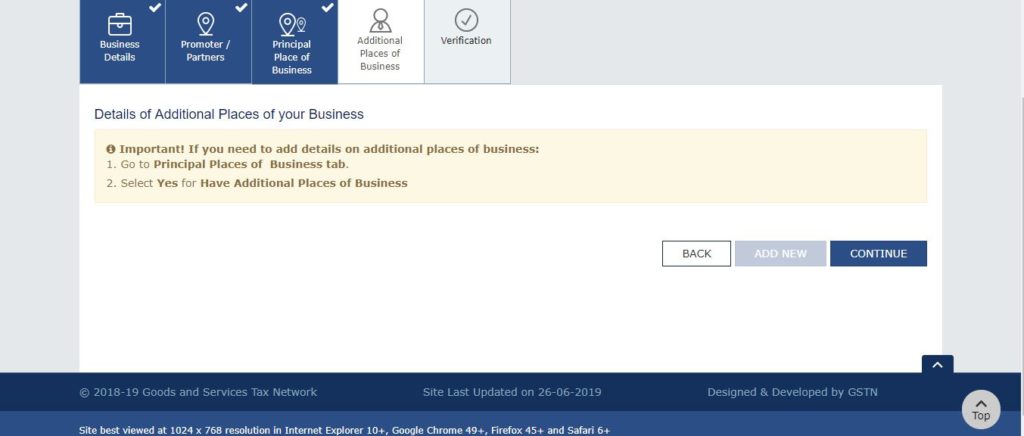

6. Additional Places of Business

Do you have additional business places? If yes you can mention all here.

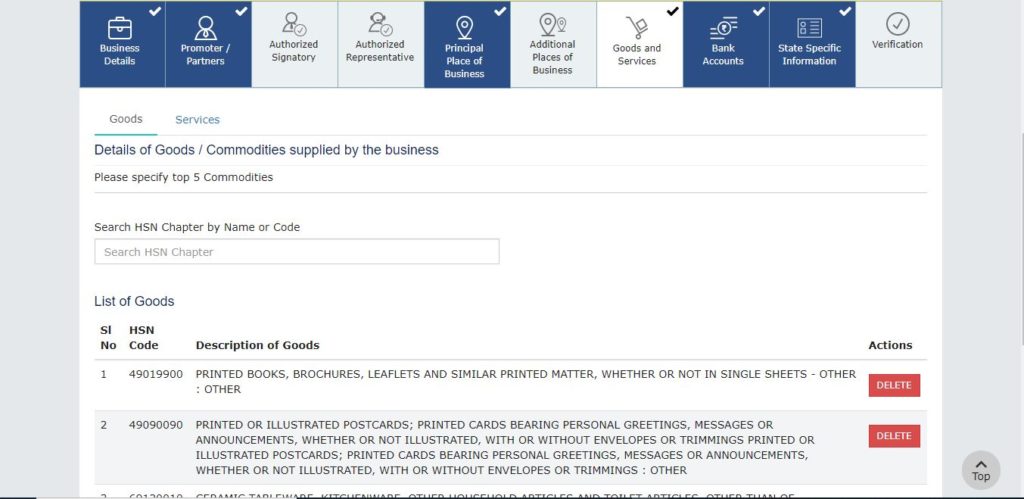

7. Goods and Services Details

Goods and services details will be filled up those are in your sales. HSN/SAC Search box made up by GSTN and here you require to enter your goods and services there.

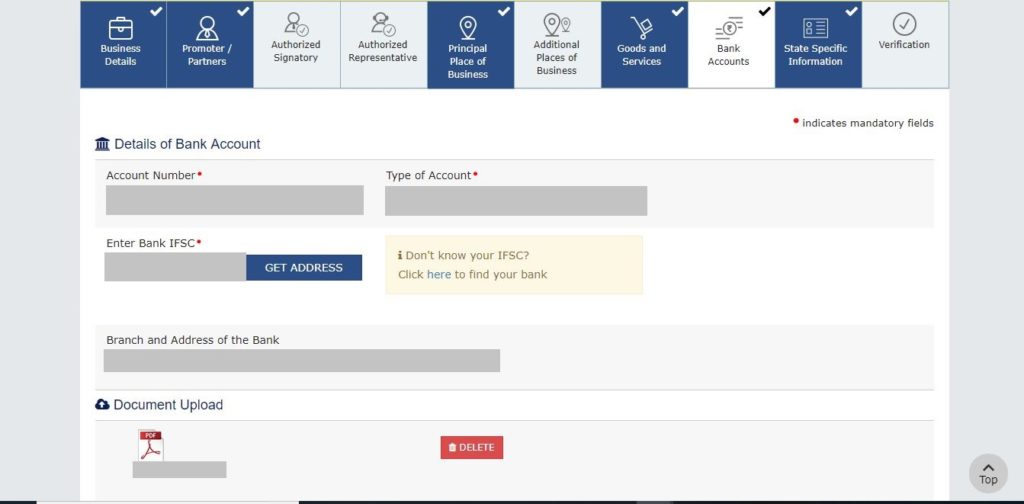

8. Bank Accounts Details

Enter your bank account details

- Account Number

- Type of Account

- Enter Bank IFSC

- Branch and Address of the Bank

- Document Upload: Upload Bank statement

- Save and continue

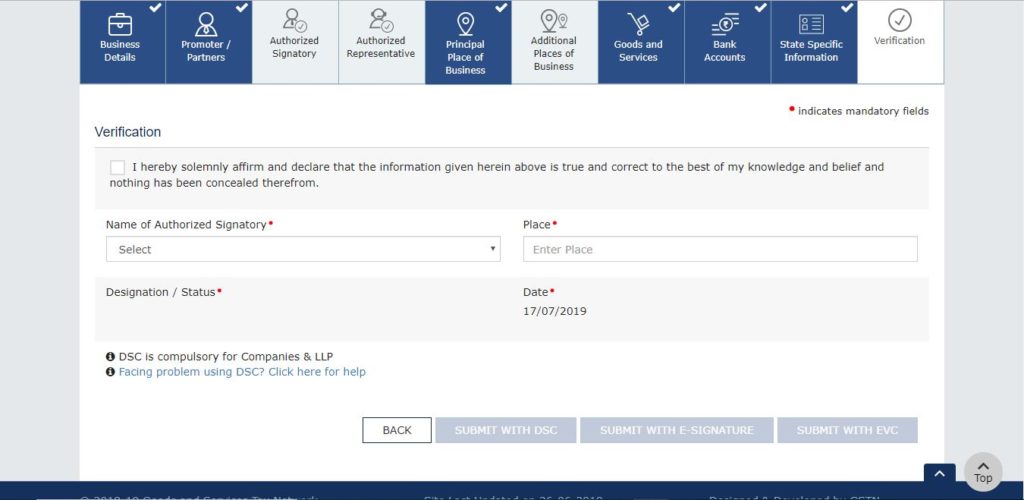

9. Verification of GST Registration

Tick ” I hereby solemnly affirm and declare that the information given herein above is true and correct to the best of my knowledge and belief and nothing has been concealed therefrom. “

Name of Authorized Signatory and Place need to be selected.

There are 3 option for verification of your application

- Submit with DSC (Digital Signature required)

- E-signature (Create e-signature)

- EVC (Required Aadhaar with attach mobile number so, OTP will be received.)

Congrats! your application has been sent for verification purpose for the GST department and it will be issued a certificate in a week. if any issues it will be informed you and you can update for them.

Registration Cost

Good news is that Registration of GSTIN is absolutely free. You don’t need to pay for the application.

Conclusion

In the above description, I have covered the whole thing about the GST registration process and make it more simple. So, you can apply for GST certificate without any help of your CA (Charted Accountant) or other. This process will take 5 to 10 minutes.

For a business owner, you should go for GST registration and filing your GST Returns. So, It will help our country development.